Currency wars do not have to play out in a random or even chaotic way – if you are in one and the same tag team that is. Fed, ECB, BoJ and BoE take turns in debasing their currencies. This can be symbolized with parachuting or even with a childrens’ dance. But the ring-a-ring-o’-roses in question is one of economic crisis.

About a year ago, a few weeks after a massive bout of monetary dilution from the Bank of Japan, Jim Rickards, a fund manager and author of a book titled “currency wars” appeared on the alternative internet show Keiser Report. He described the situation like this (my emphasis):

“A lot of people look at what the Bank of Japan did in December 2012 and now in 2013 with its massive now 1,4 trillion dollar equivalent of Quantitative Easing like this: ‘Oh my goodness, we are in a currency war.’

No, we have been in a currency war since 2010. This is just the latest battle, as I like to say. There are big battles and there are quiet periods. We had come to a quiet period, but now we are back in another one of these big battles.

It is interesting, how the intellectual superstructure (to that) has evolved. (Then Fed charirman) Bernanke is saying: This is not a currency war. They look back at the 1930ies (…)You see the problem with 1930ies was sequential devalution, so 1921 Germany, 1925 France, 1931 England, 1933 the US and so on. They sort of took turns.

But now Bernanke wants us all to hold hands and jump out of the airplane at once. In other words: If Japan, the US, the UK and ECB all ease at the same time, then – in Bernankes theory – you get a stimulus, but you won’t have a currency war because if you are alle printing at the same time, in theory the relative values, the cross rates, comparative advantage etc. should not change very much – if just every one gets eased.

Bernanke came up with a new name for this: Instead of ‘Beggar thy neighbour’ he says: ‘Enrich thy neighbour’. There is only one problem with Bernankes theory (actually there is a lot of problems with it). One of the problems is: The ECB won’t play, so the US, UK and Japan are on board but the ECB is not.

(…) It is still a currency war – you have the G4 against the G16. They (G16) are still losers. Just because the US, the UK, Japan and maybe the ECB agree on something they are the losers. You know, South Korea, Australia, Taiwan, Thailand, China, Brazil, Switzerland, all the other countries in the world. So instead of (being) G-20 all against all it’s sort of two sides, G-4 against G-16. So it’s still a currency war.

You still gonna see push back and what we should expect from this is inflation, but remember inflation comes with a lag. So it does not mean when people begin printing we have inflation the next day. Other things have to happen, behaviour has to change (…).”

Requirements for monetary freefall exercises

So far Jim Rickards. His description is not only very apt and intelligible for everybody, he also is spot on. Some minor “in- hindsight-remarks”:

First: The four big CBs never jump at exactly the same time. They get off the plane with a delay in time so as not to raise suspicions. Fed, ECB, BolE and BoJ can afford this, because together they (and not the “markets”) are able to control the exchange rates to a large extent. So far they have succeeded to manage the crossrates of the respective to-be-eased currency downwards without producing a major disruption. They were able to limit the downward trajectory of both the dollar (end 2009) and the euro (spring 2010). These inflection points were set in the course of the (“first”) euro-crisis.

Second: To maintain this ability it seems to be imperative that the currencies keep in touch and do not drift apart too much. You can call it a ring-a-ring o’roses of monetary dilution and currency crisis. ![]()

Thirdly: There were times, at which one could have questioned, whether the ECB was really part of the game – like Rickards in the above snippet. His interview stems from mid 2013, when the ECB seemed to have successfully recollected all the money from its LTROs in 2011/12. By now it is clear, that the ECB has been a player all along. According to ECB president Draghi the bank’s new covered bond purchase program should bring the ECB’s balance sheet to its former peak of 2012.

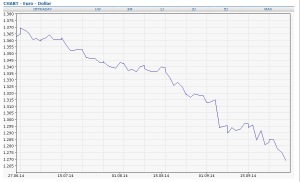

Although enthusiasm in the banks for this new type LTRO seems to be subdued, the so called “market” has already reacted – as you can see here:

Fourthly: There are some necessary preconditions to succeed with this strategy. The most important things are: You have to have “inflation expectations” under tight control and you have to shut all emergency doors, which lead to the relative safety of a currency outside the system. Of course you do not have to bar the exits under all circumstances. It could be enough to pretend, that they are barred or that there were no doors at all. Nor is it only about fiat money.

It can be about gold as well. You have to control the price of gold, which is – in the absence of a real physical market – quite simple. And you have to stop the appreciation of other currencies outside the system, either by convention (Swiss Franc) or by fostering crisis in the developing countries. In an interlinked world like ours it does not take much to achieve this.

Clearly, strategies like these cannot go on forever. Sooner or later the bluff will be called. But you can buy time. Time, you can use to prepare for the next monetary game with a set of completely different rules.

Foto: Senior Airman Matthew Bruch, Wikimedia Commons

Comments are closed, but trackbacks and pingbacks are open.