In absolute terms the size of the Greek economy is small and does not even reach three percent of Euroland’s GDP. But relatively seen, the rescue packages were a lot bigger than the US Marshall Plan from 1948 to 1951.

This assessment is based on a back of the envelope calculation in the first part of my chapter 6 “Pseudo Solutions”. You can download it tomorrow (in german). In my text I’ll walk you through the reasoning of this comparison.

This would be hardly credible if Barroso, capo di tutti capi, had not drawn this parallel himself: “The total package of assistance to Greece, if you consider the funds, grants from the structural fund, the loans, the write-off of private debt, the total package of assistance to Greece is equivalent to 177% of Greek GDP! Yes: almost the double of the income Greece can generate in one year”, he told MEPs in 2012.

I do not agree with Barroso’s calculation completely, and do not know, where his figure originates – but at large, I think, he has it right.

If you compare the funds (pledges) with the size of the receiving economy, aid for Greece was in the neighbourhood of 94 per cent of her GDP for one year. According to Eurostat the Greek nominal GDP was 222 billion in 2010. My – very conservative – estimate for the european part of the rescue programmes amounts to 210 billion Euro. The comparable figure for the Marshall Plan was 2,1 per cent.

If you look at it from the perspective of the donor, the US spent 4,9 percent of its 1948 GDP for the postwar programme.

To compare this with the european efforts from 2009 to 2013: Eurolands GDP in 2010 war 9.162 billion Euro. So the europeans spent 2,3 per cent of their 2010 GDP for Greece, roughly half of the US amount. But in 2010 the funds were directed toward one tiny country with 11 million inhabitants whereas Cold War US aid went to 17 countries in Western Europe.

The european recue packages were designed to avoid a sovereign default and no part of it was used for the building of infrastructure and/or productive capacities. Neither the Hellenic Republic nor its citizens werde the real beneficiaries of the so called european “solidarity”.

It only helped in two ways: It prevented an immediate collpase of the Greek state strucutures. Secondly, a big part of original private investors in Greek government bonds managed to get away unscathed – at the expense of european taypayers. The social and economic fall out of the “rescue packages” was/is harsh, with the greek population bearing the human and the rest of the europeans the financial costs from the programme.

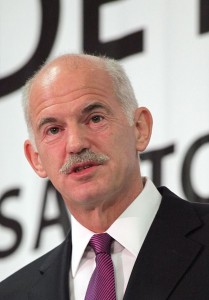

Foto: PASOK

Comments are closed, but trackbacks and pingbacks are open.