The recent rise in gold prices is not necessarily an ominous sign for the impending unravelling of the financial system. But it may be a move to prolong it by coaxing holders of physical to part with it. Anyway, the paper bull must not be maintained for an extended period as it does not go along with negative interest rates and financial repression.

What has been happening during the last three weeks is shown by this Leprechaun. ![]()

This is no investment recommendation nor do I claim to have special training or inside information of monetary matters. What follows is my take of what I see in PM and financial “markets”. I may be wrong.

While some see gold prices as a harbinger of a further breakdown of the Euro and others as a consequence of the de-pegging of the Swiss Franc there is a fundamentally different perspective on it.

To begin with, one must not forget, that EVERY DAY several thousand tons of “gold” are sold at the LBMA in London and several hundred tons at COMEX.

That’s how the price discovery for the supposed metal takes place. There is no real or realistic pricing. In case that there really had been more safe haven demand, it would have been small fries in comparison with all the “business as usual” paper contracts. (Nor did it look like an event that was triggered by higher demand at the margin. We saw standardized, five dollar gains every day over a period of a couple of weeks.)

No, these developments have nothing to do with demand/supply of finite goods. The management of the $ POG (dollar price of gold) is well and alive – as is the management of other currencies. Its all about currency operations. If one is not in the know of the CB’s game plan it does not mean, that the game does not exist at all.

One has to come to terms with the fact, that $ gold is a fiat currency, dressed up as a metal. In late 2013 or at the beginning of last year $ POG has been attached to the greenback, but in a very peculiar way. This “peg” is a different animal. The POG does not have to follow the Dollar on a daily basis. Nor should it.

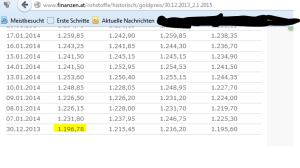

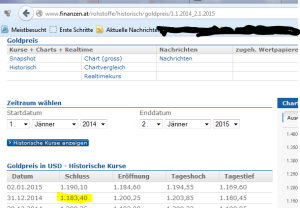

The reference price in 2014 was 1.200 $ and probably continues to stay there. Please have a look at the $ POG in 2013 and 2014 at year’s end respectively.

The $ POG was allowed to stray off the “reference price” in the first months, but it seemingly had to return at the end of the agreed-to period: Heel ! Most importantly, the $ POG was not allowed to give the impression that it may appreciate against the Dollar on a mid- to longterm basis. Under no circumstances !

Until September 2014 the $ POG was frolicing around beyond 1.250 Dollars and in mid march, at last year’s high, it reached nearly 1.400 dollars “per ounce”. In autumn it had to descend to the basement – only to resurface at year’s end at 1.200.

What does this strange, unconventional way of leashing “gold” to the US-Dollar mean ?

That the system is stuck between a rock and a hard place. It tries to keep away from both.

***

First a few words regarding the unnatural stability of $ POG in 2014. It was an extremely wondrous phenomenon indeed.

Other currencies and oil turned out to be highly volatile. The Dollar appreciated against the Euro more than 13 per cent, as it did against the Japanese Yen. It even gained 76 per cent against the ruble, and the price of oil was cut in half.

It was not a year that can be understood as a year of stability.

Nor had 2013 been one. That year had been characterized by huge derivative operations in the futures markets, which had forced the $ POG down 28 per cent, leading to many hundred tons of additional physical outflow from the western financial system.

Another year like that and the flow of physical gold from west would probably have dried up. This is why “they” chose to try and keep the $ POG stable.

***

Now for the most important reason, why the $ POG cannot be allowed to go higher. It is real interest rates. If you want to maintain negative interest rates, you have to prevent the $ POG from climbing, otherwise you would create a loophole which allows intelligent savers to escape.

Financial repression is a heinous, rapacious act, one could talk about for hours. But for practical purposes I leave it at that: ZIRP, NIRP and especially falling interest rates are not possible within the environment of a rising POG.

Nevertheless – as 2014 has shown, it is not even enough to keep the $ POG stable on a year to year basis. It could NOT prevent the system from shedding physical gold.

***

How can one know this ?

Now – I have to admit to a conjecture, but I think it is a venial sin. The physical “market” is very, very opaque for “mortals”. Nearly impenetrable. But there is a proxy for it and its name is GLD, the big ETF.

For a change this ETF seems to be backed by physical in full. They have a bar list, which has withstood quite some scrutiny (as I happen to remember).

The holdings of this ETF can very well serve as a pars pro toto for the amount of physical gold “in the system”.

Last year, every time the paper price was pushed higher, the system was able to stop the drain in GLD for a while (or even reverse it for two weeks or three.). You can check this out for yourself. Rising paper prices somehow seem to increase the amount of readily available physical gold in the western part of the world.

For reasons clarified above, there is no option to boost the $ POG on a sustained basis. So it was on and off, rising and falling $ POG to hold the balance between keeping up the flow of physical gold and keeping off savers from (long) speculation.

Contrary to their “mission” the stewards have been increasing the $ POG since the start of 2015 – which has resulted in the addition of ca. 33 tons GLD inventory (year to date).

But in order to repell frustrated savers/investors, they will have to shift again to the reverse gear in the forseeable future.It has to be perfectly clear, that “there is no emergency exit here – move on !” (Maybe this has already happened).

As one can see, it is a delicate balance. Either way the system has to move slowly and with interruptions in order not to upset the whole apple cart.

As mentioned above a mere flat $ POG does not do the trick. In 2014 GLD inventory lost 89 tons. And if GLD is a proxy of a broader physical market indeed, stocks in Europe and the USA must have kept trickling away.

***

Probably more than that. Any indication from Asian statistics points to the fact, that the flow of physical from west to east did not stop in 2014.

That means that the big picture of 2013 – as painted here – has persisted in 2014.

To back this up, two quick statistical “facts”: The People’s Republic imported at least 1.200 tons in 2014, perhaps 300 tons less than in 2013.

But this shortfall was compensated by India, which has eased her restrictions and is likely to have imported more than 1.000 tons (officially).

This amounts to the fact, that two asian giant nations have again gobbeled up some 70 pc of the world’s new physical production – all alone.

This is simply not sustainable and it has to be stopped somehow.

It can be done by either changing the whole financial system or by inventing new ways to manage the situation and delay the end game further. Here another currency crisis would come to mind, or encouraging indian/chinese authorities to shut down gold imports again (and doing it more effectively this time) – or by feeding substitutes to the indian consumer (silver and god knows what else). This is no an easy task at all, but if one wants to maintain the flow of real gold, something has to be done.

***

So what is the gist from all of this ?

The stewards of the $ system will have to take down the POG at some point in time in the near future. And – as always – a story will be needed to explain this move. A story, that is at least moderately plausible.

The ECB meeting on January 22 could deliver a punch line to this effect: “The ECB is doing nothing or too little in terms of increasing its base money, which is grossly gold negative, etc.” (When it comes to the owners of artificially inflated assets no central bank will ever “have done enough”.)

Another possibility would be the current price of crude oil and its relation to gold. The oil-to-gold-ratio is a metric, which has been “rangebound” from 12 to 14 for a very, very long time – which means: You could get 13 (or so) barrels for 1 oz. of gold. Right now the OGR is at 27 because of super-cheap oil.

Every time the OGR exceeded its normal range substantially, it came crashing down in a big way. Please have a look.

Of course this divergence could be solved in another way as well, but it would make for an elegant explanation for a substantial decline: “What do you want ? Gold was hugely overvalued !”

I find it hard to believe, that the POG is going to be cut in half because this could turn out to be lethal in no time. Moreover I do not think, that there will be a smash like it was done five years ago. This would be too risky also. Probably “gold” will be driven lower over a period of several weeks, in a mirror-image of what it did on its way up.

To round things up: During the last three weeks, the $ POG has been allowed to rise to 1.300 dollars “per ounce” (comparatively more in terms of a weakening Euro). This has created a gain of 30+ metric tons in GLD (to 740 from 709 tons) – and probably a corresponding uplift in the general “water level” of readily available real gold from western vaults. Maybe enough to muddle along another month or two.

Comments are closed, but trackbacks and pingbacks are open.